The Price Of Passion

Owning a classic car isn’t just about turning heads—it’s about preserving rolling art. But keeping that vintage beauty on the road comes with one inevitable modern hurdle: insurance. And while you might think your weekend-only cruiser should cost less to insure, classic car coverage plays by its own rules. Here's why insuring your classic car is so much more expensive than your wife's everyday driver.

Why Classic Car Insurance Is Different

Classic cars aren’t everyday vehicles—they’re often decades old, meticulously maintained, and driven sparingly. That means traditional insurance doesn’t quite fit. Instead, owners turn to specialized classic car insurance, which values vehicles based on their collectible worth, not their depreciated market value.

The Agreed Value Advantage

One major difference is how insurers determine what your car is worth. Instead of “actual cash value,” you and your insurer agree on a set figure upfront—so if disaster strikes, you get exactly what your prized ‘67 Mustang or ‘73 Porsche 911 is truly worth.

Greg Gjerdingen from Willmar, USA, Wikimedia Commons

Greg Gjerdingen from Willmar, USA, Wikimedia Commons

How That Affects Premiums

Of course, this protection doesn’t come cheap. Because agreed-value policies ensure full payout, insurers often charge higher premiums to offset the potential risk. You’re paying for certainty—and peace of mind.

Mileage Matters

One of the biggest factors in your premium is how much you actually drive. Classic insurance policies usually include strict mileage limits—often between 1,000 and 5,000 miles a year. Exceed that, and you’ll either pay more or risk losing your classic status altogether.

Storage Is A Big Deal

Insurers love a locked garage. Vehicles kept in secure, climate-controlled spaces are far less likely to be stolen, vandalized, or weather-damaged. The safer your setup, the lower your rates—so that fancy alarm system or storage unit might actually save you money in the long run.

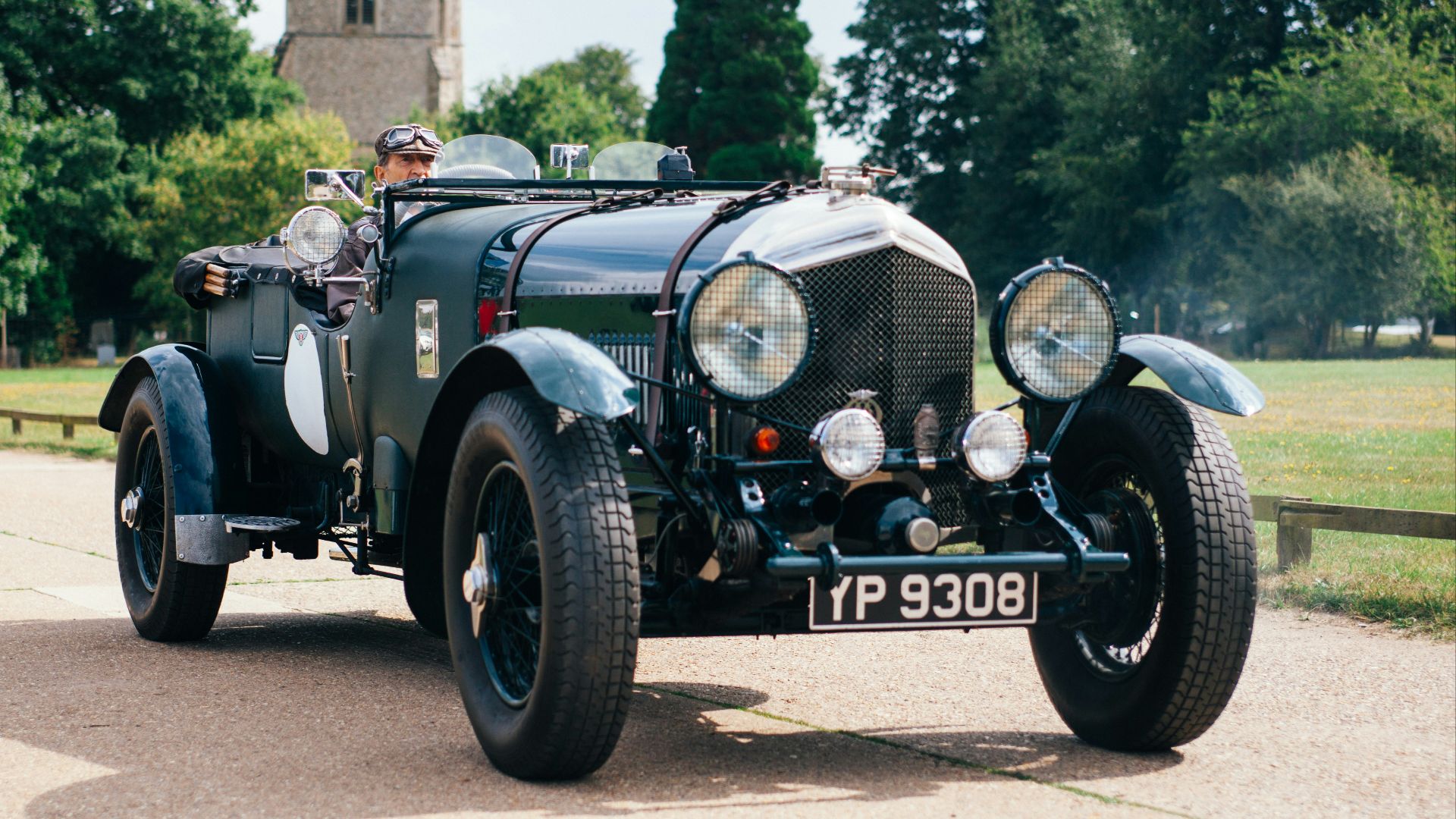

Age & Rarity: A Double-Edged Sword

The older or rarer the car, the more expensive it can be to insure. Replacement parts can be rare, specialized labor costs skyrocket, and even small fender benders can turn into restoration projects. But these same qualities also make your ride more valuable—so you can’t really lose.

The “Collector” Requirement

Most insurers won’t offer classic coverage to just anyone. You’ll usually need to show that your classic isn’t your daily driver and that you have a modern vehicle for everyday use. It’s not snobbery—it’s risk management.

The Driver Factor

Your personal driving record still plays a big role. Even with a spotless 1969 Camaro, a messy record full of speeding tickets or DUIs will hike up your premiums faster than a quarter-mile drag run. Safe driving keeps your insurance affordable.

Jeremy from Sydney, Australia, Wikimedia Commons

Jeremy from Sydney, Australia, Wikimedia Commons

The State You Live In

Insurance laws vary by state, and so do costs. Classic car insurance in California might look very different from policies in Ohio or Texas. Everything from local theft rates to climate hazards affects how insurers calculate risk.

Appraisals Are Your Friend

Getting a professional appraisal helps establish your car’s true value. Some insurers require it, while others take your word (and photos) for it. Either way, the more documentation you have, the easier it is to secure a fair policy—and prove your car’s worth later on.

The Importance Of Usage

Are you taking your car to weekend shows, track events, or just Sunday cruises? The type of driving matters. Some policies forbid racing or track days altogether, while others charge extra for it. Be honest about your habits—fibbing can cost you coverage.

Modifications Can Complicate Things

Many classic cars have been lovingly restored, modified, or upgraded. But not all insurers see that as a plus. Performance enhancements can raise your premium, while period-correct restorations might actually reduce it.

Why Standard Insurance Falls Short

Regular auto insurance just doesn’t cut it for classics. Standard policies assume depreciation, limited lifespan, and daily use—all the opposite of a collectible. A “total loss” claim under regular coverage could leave you thousands short of your car’s real value.

Comparing Costs To Regular Cars

So how much more does it really cost? While a standard modern vehicle might cost $1,500 per year to insure, a classic policy could range from $800 to $3,000—depending on usage, storage, and value. It’s not always higher, but the stakes definitely are.

Insurers That Get It

Not all companies understand the quirks of classic ownership. Specialized insurers like Hagerty, Grundy, and American Collectors Insurance tailor their plans for enthusiasts—offering perks like flatbed towing and show coverage.

The Hidden Discounts

Believe it or not, you can still score discounts. Multi-car policies, anti-theft devices, and limited mileage all help trim costs. Being a member of a recognized car club can also unlock special rates.

When To Revisit Your Policy

Your car’s value can change—sometimes dramatically. A model that was worth $40,000 five years ago might fetch $70,000 today. Regularly updating your policy ensures your agreed value reflects current market trends and auction results.

The Perils Of Underinsuring

Choosing a lower agreed value to save money might seem smart—until you need a pay-out. Insurers only pay what’s on paper, not what you think your car’s worth. Don’t short-change your investment for short-term savings.

Claims: What Happens After A Crash

If the worst happens, the claims process for classics is usually more personalized. You’ll often work directly with an adjuster familiar with vintage cars. Many insurers even allow you to choose your own restoration shop, which means you won’t be forced into cookie-cutter repairs.

Seasonal Storage Coverage

If you only drive during certain months, you can save by switching to “storage” or “lay-up” insurance for the off-season. This type of policy suspends road coverage while keeping your car protected from theft or fire in the garage.

Event and Show Coverage

Many classic car insurers include (or offer add-ons for) car show and parade coverage. That means if your ride gets dinged during a festival or concours, you’re still protected. It’s peace of mind for the spotlight.

Overseas Coverage and Shipping

Shipping your car to an overseas show or rally? Specialized coverage can protect your classic during transit—whether by land, sea, or air. It’s niche, but for serious collectors, it’s a must-have.

How Inflation Affects Your Premium

Inflation doesn’t just hit the grocery store. The cost of materials, parts, and labor all rise over time, and insurers adjust their rates accordingly. A repaint that cost $5,000 ten years ago might cost $12,000 today—and your premium follows suit.

A Real-World Example

Imagine two owners: one with a 1985 Corvette driven 2,000 miles a year, and another with a 1963 Jaguar E-Type driven only on weekends. The Corvette might cost around $1,000 annually to insure; the E-Type, perhaps $2,000. Both enjoy agreed-value protection—but rarity and parts availability make all the difference.

John Robert McPherson, Wikimedia Commons

John Robert McPherson, Wikimedia Commons

The True Cost Of Love

At the end of the day, insuring a classic car isn’t just about money—it’s about respect for history, craftsmanship, and passion. You’re not paying to drive a car; you’re paying to preserve a legacy.

What Does Your Classic Car Insurance Cost You?

So, what does insurance for a classic car really cost? More than a commuter hatchback, sure—but for many enthusiasts, it’s worth every penny. You get coverage designed for your car’s true value, protection that respects its rarity, and peace of mind knowing that if the unthinkable happens, your beloved machine can rise again. After all, classic car ownership isn’t about saving money—it’s about saving stories.

You May Also Like:

There's A Hidden Meaning Behind The "98" In The Oldsmobile 98

The Most Reliable Car Brands To Drive In America In 2025